DraftKings’ 11th-hour bid to usurp Fanatics and block it from buying PointsBet looks to have fallen flat on its face.

PointsBet announced on Tuesday night that DraftKings missed its deadline to finalize its offer.

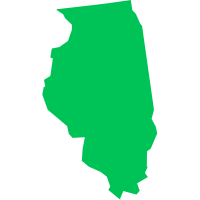

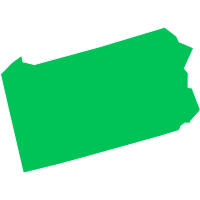

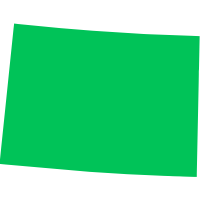

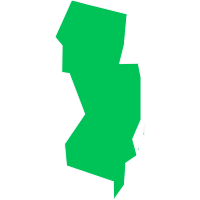

That’s after DraftKings made a last minute, $195 million salvo earlier this month to purchase PointsBet and prevent Fanatics from attaining much-coveted sports betting licenses in New York, New Jersey, Pennsylvania and Michigan.

Fanatics had previously agreed to a roughly $150 million deal to acquire PointsBet’s American arm.

That deal has since been sweetened to $225 million in light of DraftKings’ 11th-hour bid.

DraftKings’ non-binding bid needed finalizing from both sides. PointsBet and DraftKings negotiated terms of the deal in the interim, but ultimately, time ran out to come to a binding offer.

DraftKings’ now-dead offer wouldn’t have generated much in the way of profits, even in the long run. Nearly every state that PointsBet operates in, DraftKings does as well — so this wasn’t a play for market share. And DraftKings already has robust departments in risk management, trading and otherwise — so this wasn’t about poaching PointsBet talent.

Simply put, DraftKings attempted to block a competitor with deep pockets from entering its territory. And it failed mightily in doing so.

It stands to reason as to why DraftKings tried so hard to prevent Fanatics from taking its market share.

Research analysts across gaming expect Fanatics to immediately compete with the two leading industry titans — DraftKings and FanDuel — once the company’s sportsbook is expected to launch ahead of the 2023 NFL season.

“Backed by Fanatics’ resources for product development and marketing — and a massive database to market to — the operator could take significant share in our view,” Eilers and Krejcik wrote in a recent report.

PointsBet shareholders are scheduled to vote to approve Fanatics’ bid on Friday morning.

This is not the first time that DraftKings has called off a prospective deal. The sports betting behemoth famously canceled its $22 billion buyout of Entain, the owner of Ladbrokes, in 2021. Regulatory concerns were an issue then, as they might have been in the PointsBet deal.

Fanatics’ new $225 million offer is still a drop in the bucket for the company, which was last valued at $31 billion.

The key to the deal, as aforementioned, is ready-made sports betting licenses in a few key states.

In New York and Michigan, no licenses would be available for Fanatics without an acquisition. Fanatics may have had trouble attaining the New Jersey market, too, without purchasing an existing licensee. New York and New Jersey are the country’s two biggest markets — ahead of Vegas and Nevada.

There's also iGaming — table games, slots, etc. — in Michigan, Pennsylvania and New Jersey, which have much higher profit margins than sports betting does.